What Bitcoin mining is and how it works: 2026 guide

Jan 27, 2026・8 min read

Bitcoin (BTC) – the world’s first widely successful cryptocurrency – inspired millions to explore new ways to grow wealth beyond traditional assets. While many people focus on trading BTC, others try to acquire this crypto directly via mining.

Bitcoin mining is both a technical process and an economic system, since miners secure transactions and release new BTC into circulation. In 2026, this process is more complex than ever, thanks to large networks and high target difficulties. Although small setups still exist, most mining power now comes from industrial-scale facilities that run application-specific integrated circuit (ASIC) hardware.

In this guide, we’ll walk you through how BTC mining works and what you should know about it in 2026.

What’s BTC mining?

BTC mining uses computer power to validate transactions and create new blocks on the Bitcoin blockchain in exchange for block rewards and fees.

The blockchain itself is built on a proof-of-work (PoW) system. Every pending block of transactions is turned into data that’s converted into a unique string of characters via hashing. Miners then use computer power to search for a valid output that fits a specific difficulty target. The machines keep trying new values until one of them produces a result the network accepts.

When a miner finds the right result, the new block is added to the chain, and the transactions inside that block are legitimized. The miner receives the block reward, along with the fees from transaction owners.

This PoW process keeps BTC decentralized and secure. There’s no single entity that approves transactions, just independent miners across the world that follow the same rules and can't take any shortcuts.

Early miners could use home computers or GPUs to participate in the BTC validation process. But today, purpose-built ASIC machines dominate BTC mining. They’re faster, more efficient, and can handle sustained operation. The prevalence of ASIC machines has raised the baseline for participation, so hardware quality and operating efficiency matter as much as (or possibly more than) technical knowledge.

As more miners join and total computing power increases, there’s a risk they’ll find new blocks too quickly. The PoW protocol responds by increasing target difficulties, so the average block creation time stays close to 10 minutes.

How does Bitcoin mining work?

Bitcoin mining follows a precise sequence of steps that organize the data, prove the work performed, and give the network a reliable way to decide which block gets added to the chain. Here are the key elements in that process.

Creating the hash

A hash is a cryptographic output that converts digital data into a fixed-length value. Bitcoin uses a hash function called SHA-256, because this function produces consistent results from the same input and responds strongly to changes in the data. This sensitivity to change helps the network verify authenticity and detect tampering.

When miners prepare a candidate block, the node software arranges all included transactions into a cryptographic structure called a Merkle tree. Transaction hashes combine layer by layer, until a single value remains. This value is the Merkle root, and it represents every transaction inside the block.

The Merkle root joins the previous block hash, block version, timestamp, difficulty target, and nonce (a randomly generated number) in the new block’s header. Miners hash this header twice using SHA-256, and get a result that looks like this:

4e87d1657ff1fc73b92ab98128a1d65dfc2d4b1fa3d677284addd200126d9369

This value captures the exact state of the block header at the moment it was created. Miners can adjust specific header fields and hash again until one of their outputs fits the block’s difficulty target.

Target hash, difficulty, and nonce

Every block has a target hash that defines what counts as a valid result. A block becomes valid when its header hash is less than or equal to that target. The protocol uses this target to control how much computational effort miners must expend to discover the next block.

Bitcoin recalculates difficulty every 2,016 blocks, aiming to keep block creation at a 10-minute rhythm. When miners add hash power, the network raises difficulty by tightening the target. When hash power declines, the protocol loosens the target so block production doesn’t slow indefinitely.

The nonce is the value miners adjust on each hashing attempt. A miner hashes the block header, checks the result, increases the nonce, and hashes again. Once the miner runs through the nonce range, the software updates other mutable values, such as timestamps and the extra nonce fields inside transactions, and the search continues.

Miners advance through these inputs as fast as their machines allow, and one of those attempts eventually produces a header hash that falls inside the permitted target range. ASIC miners can do this at extraordinary speed, scanning through ranges of candidate values and producing immense volumes of hash attempts every second.

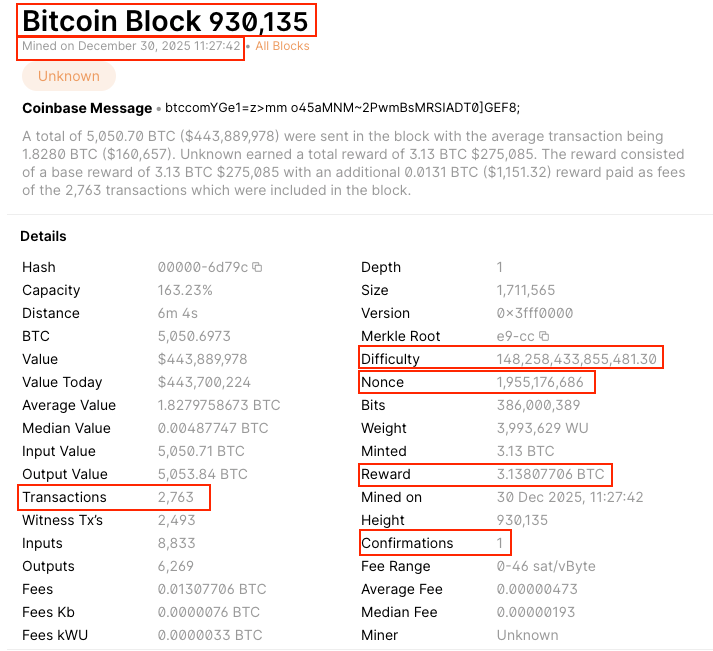

Real-world example: Mining block 930,135

Here’s a real example from Blockchain.com that shows BTC mining in practice.

Source: Blockchain

[Alt text: The BTC block page on Blockchain’s website, with a Bitcoin block number at the top and mining information in a table format.]

Bitcoin block 930,135 was mined on December 30, 2025, and it includes 2,763 transactions. All of those transactions are represented in the Merkle root shown in the block header.

For this block, the winning nonce was 1,955,176,686. The miner hashed the block header repeatedly while increasing the nonce, until one hash met the difficulty target. The Bitcoin mining difficulty at the time was 148,258,433,855,481.30, and the expected workload was roughly that difficulty x 2³² hash attempts across the network.

The successful miner received a little over 3 BTC in mining rewards, made up of the original BTC subsidy plus transaction fees.

The block currently shows one confirmation, which means that one more new block has already been added above it. As more confirmations accumulate, the work required to replace this block will increase, making the transactions it records more final.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

Types of Bitcoin mining

There are various ways to conduct mining, and each type of BTC mining hardware and structure affects costs, efficiency, and reliability. Here are the most common options.

ASIC

ASIC miners are specialized machines built for BTC. They deliver far more hashing power per unit of electricity (hundreds of trillions of hashes per second) than any other type of hardware, so almost all competitive mining today happens on ASICs. These machines are expensive to buy and operate, and they set the performance baseline for the Bitcoin network.

GPU

GPU mining played a meaningful role in BTC’s early years, when network difficulty was much lower. Today, GPU mining can’t match ASIC’s efficiency or output. Most GPU miners focus on altcoins like Ravencoin (RVN) and Flux (FLUX), where the hashing algorithms are better suited to this kind of hardware.

CPU

CPU mining happens on a standard computer processor. Since CPUs operate many orders of magnitude below ASIC performance, this is no longer a valid BTC mining option. The performance gap is so wide that a CPU could mine for decades without discovering a block.

Cloud

Cloud mining lets you lease hash power from a remote provider instead of running your own hardware. In theory, this simplifies access to mining, but in practice it can be a problematic option that's prone to crypto scams.

For example, in one widely reported case, operators from the HashFlare cloud mining service pleaded guilty to selling contracts without the mining capacity they promised. This scheme generated hundreds of millions of dollars before collapsing. And even if a cloud mining offer is legitimate, the contract fees, operational costs, and third-party platform risks can absorb most of the potential returns.

Mining pools

These days, many miners don’t work on their own. They join mining pools, where people combine their hash power and share any resulting new coins and rewards based on how much work they each contributed. This is the most viable option for individual miners who can't afford ASIC hardware.

Factors that influence BTC mining profitability

BTC mining is sometimes profitable, but how much depends on the value of mining rewards, cost of electricity, efficiency of hardware, and current state of the network. Profit margins tend to be thin, especially for beginners.

When deciding whether BTC mining is worth the investment, you’ll want to consider:

- BTC price: Profitability increases when BTC trades higher and decreases when the coin’s price falls.

- Energy cost: Electricity is usually the largest recurring expense, and lower power rates reduce operating costs and extend mining equipment viability.

- Hardware efficiency: Modern ASIC machines differ in hashrate and energy usage, and some devices can perform the same work at a lower cost than others.

- Mining difficulty: When more hash power enters the network, difficulty rises and the same reward is shared across more computational work, reducing expected returns.

- Halving effects: Each BTC halving cuts the amount of new BTC entering circulation and reduces mining rewards.

- Pool fees and payout structures: Mining pools can improve earnings, but they also charge participation fees that reduce gross returns.

Alternatives to BTC mining

Mining BTC isn’t the only way to earn money with crypto; here are some other popular options.

Buying and holding BTC

The most common alternative to mining is buying BTC directly and holding it. With this method, you gain exposure to price movements without paying for electricity, hardware, or maintenance. And for most individuals, buying and holding BTC produces more reliable results than operating a single ASIC or other small setup.

Trading BTC

You can also trade BTC, such as through spot trading or derivatives like futures and perpetual contracts. Trading profitability doesn’t depend on network difficulty or energy costs, but it does rely on market conditions, liquidity, and risk management. This alternative can outperform small-scale mining during active market periods, although it requires skill and a tolerance for crypto volatility.

Investing in BTC mining stocks

Another option is to invest in publicly traded mining companies like Riot Platforms, MARA Holdings, and CleanSpark. These companies operate at an industrial scale, with lower energy costs and more efficient hardware than typical retail miners. Investors gain exposure to mining economics through equity rather than hardware ownership, and returns depend on both BTC’s price and company performance.

BTC cloud hashpower contracts

Cloud hashpower contracts allow users to pay for remote mining capacity instead of operating their own machines. While this removes hardware management, contract fees and platform risk can reduce expected returns.

How Bitcoin mining affects taxes

In the United States, all BTC miners must report their earnings to the IRS. But the exact crypto tax implications depend on whether the miner operates as a hobbyist or business.

For hobby crypto miners – those who mine on a smaller scale without a formal business structure or regular commercial activity – mining rewards are reported as income. Mining-related expenses, such as electricity and maintenance costs, generally can’t be deducted.

For business miners – those who operate with a profit motive and treat mining as an organized commercial activity – mining rewards are also taxed as ordinary business income. However, businesses can deduct eligible operating expenses, including the costs of hardware purchases (subject to depreciation rules), electricity, repairs, hosting, and mining software.

If you later sell, exchange, or spend mined BTC, it also counts as a capital gains tax event. You can calculate the gain or loss using the asset’s fair market value when it was received and its value at time of disposal.

Don't let tax complexities slow your BTC mining journey

Concerns about tax implications can complicate even the best mining plans, but the right tools remove that barrier. CoinTracker connects to your wallets and exchanges, generating optimized tax reports in minutes to ensure accurate tax reporting and reduce the risk of errors or audits. CoinTracker also offers valuable insights into your mining profits and overall portfolio performance, allowing you to make informed decisions and maximize returns.

Worried about reporting your crypto taxes? CoinTracker makes it simple. Join over three million users who trust us for hassle-free tax reporting. Start for free today.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.